If you can’t beat ’em, join ’em?

August 24, 2023

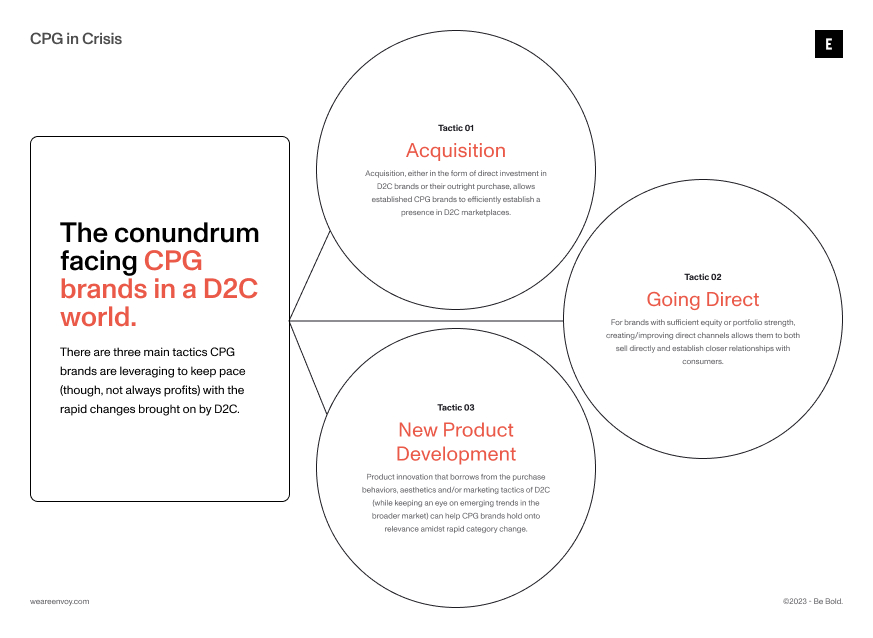

The Conundrum Facing CPG Brands in a D2C World

Spotlight: Masterbuilt

Building D2C brands fit to be bought.

While CPG brands are eyeing upstart D2C brands, so too are D2C brands eyeing acquisition. When Masterbuilt came to Envoy, they were a pure-play retail brand, selling their barbeques and a new line of smokers out of big box retailers like Walmart and Home Depot. We re-tooled the traditional hard goods brand as a connected product for the D2C marketplace. With a refreshed brand strategy, we launched a new ecommerce platform replete with content like recipes, brand storytelling and tips and tricks for users. But the connected product design was the lynchpin that brought Masterbuilt’s smoking experience from the aisles of retailers and into the realm of consumer technology. Supported by a full IoT infrastructure, we developed an app that put control of the smoking outcomes in the palms of consumers new to the experience. Once the launch was live, we supported ongoing analytics and optimization, continuously driving value for their D2C presence. The D2C efforts generated $40M in revenue, accounting for 30% of their annual revenue and ultimately contributed to their acquisition by Middleby Corporation in 2021.

New brand, who ‘dis?

CPG manufacturers are also investing in the long game, innovating new products for the D2C channel. Ocean Spray, the purveyors of all things cranberry (and this awkwardly unforgettable spot), have, for instance, launched an innovation incubator with the goal of originating competitive D2C products in health and wellness. Even Clorox has launched its own line of health supplements, Objective Wellness, targeting a mobile-first target that skews younger than their traditional audience of bleach users.

Of course, D2C is more than a channel; it’s also an aesthetic. Reckitt’s Little Yawn Collective line of melatonin-free sleep products for kids and Procter & Gamble’s line of cleaning products, NBD Clean, both appear to be digitally-native, indie brands with their Instagram-first design and influencer-inspired nomenclature. Indeed, as social commerce becomes a more viable channel and Gen Z, a generation that is really only reachable via social media garners greater influence over purchase decisions, looking like or behaving as a D2C brand can help CPG manufacturers stay relevant amid shifting tides.

Meaningful innovation in this category is more than producing “look-alike” brands for D2C competitors. As the lifestyle changes brought forth by COVID are inspiring new use occasions, CPG manufacturers are realizing the potential of products that rise to meet those needs. And the launch of digital-first, innovative product sets offers larger CPG manufacturers the flexibility to innovate more quickly and respond to consumer demand in real-time—like Danone’s 2021 launch of Honest to Goodness. With fewer people caffeinating on the commute, Danone saw an opportunity for healthier, more socially responsible at-home coffee experiences. Their new plant-based creamer is certified vegan, keto-friendly, certified gluten-free and Non-GMO Project verified, sold exclusively online and supports their larger mission of sourcing their ingredients sustainably and locally. Even Mountain Dew got in on the content game, partnering with influencer Druski to release The Dew Zone, a branded podcast series.

Spotlight: Campbell’s Well Yes

From CPG mainstay to challenger brand

When Campbells came to us, the soup aisle was changing. From hearty stews and convenient comforts, a new, increasingly female shopper was looking for healthier, more wholesome alternatives. In helping Campbell’s look at the soup aisle they had long dominated with the eyes of a challenger, we conceived a new-to-world brand, Well Yes!, that tapped into an intersectional truth about the consumer, the category and their brand: transactional eating is an enemy to wellness. Conceived as an antidote to eating for the sake of food, Well Yes! offered health-conscious consumers an opportunity to say yes to eating nutritious ingredients that were better for them and their families. From concept through brand strategy and design, we worked with Campbell’s senior team to bring a transformational shift to a traditional space. In the end, Well Yes! was named a new product pace setter by IRI, surpassing $47M in sales in the first year and, ultimately, a platform brand that would be extended into new formats.

Going direct

Then there are those brands who have jumped into the world of D2C whole-heartedly, selling directly to consumers and adopting the marketing tactics native to D2C channels. A survey by Deloitte showed that 88% of CPG companies were looking to make moderate to significant investments in creating or improving their direct selling channels. While owned properties haven’t always had the pull of marketplaces like Amazon, where consumers can browse and compare options, some brands are betting on themselves and developing net-new ecommerce properties under their own banners. With snacking on the rise by as much as 35% since pre-pandemic, grocery CPG brands like Pepsi, Kelloggs and Heinz have all doubled down on DTC, creating new platforms that sell directly to consumers, relying on the leadership each enjoys in their respective categories.

Of course, D2C channels aren’t just for selling and buying; they are also powerful levers of influence. Three-quarters of CPG shoppers, for instance, use digital channels to inspire, research and choose a brand, whether or not they buy there. The rise of the influencer continues with brands investing in partnership programs that enable them to both influence purchase decisions and sell direct. Fiji water, for instance, partnered with health and wellness influencer Danielle Bernstein to position their premium water as a part of aspiration for wellness– with clout. CPG stalwart, and Envoy partner, Campbell’s likewise teamed up with food influencer Richard Blais on Pinterest, a platform popular as a source for recipe inspiration, to produce an affordable meal series featuring Campbell’s products.

The small matter of profitability

While the explosion of D2C brands does pose a threat to traditional CPG brands and ways of marketing, jumping in and “joining them” comes at a cost to their bottom line. Shipping and packaging for one-off sales eat into manufacturer margins far beyond wholesale costs.

Then there’s the additional expense of connecting one-to-one with consumers. While the benefits of consumer data and relationships are often cited, it is costly to invest in new platforms and even paradigms in product development and brand marketing.

Compounding the hard costs of D2C is also the competition. The D2C landscape has never been more competitive. Millennial and Gen Z consumers are not just apt to try new products but are not programmed to be as brand loyal as previous generations. As the IPOs for celebrated D2C brands like Warby Parker and Casper have shown- success in the world of D2C does not always, even rarely, equal massive profits. Likewise, attempts to grow into brick-and-mortar from D2C channels have been rocky, even for the most celebrated brands. All this is to say that, while the grass may look greener for D2C, it’s an expensive proposition for brands, new and old. The D2C model has a shiny appeal, especially in a post-COVID world, but there is a danger in confusing what success looks like for a new-to-world brand and how success is measured by traditional CPG players, their shareholders as well as the markets.

Key Takeaways

D2C is not a strategy in and of itself. CPG brands, and really any enterprise considering going-direct-to-consumer, must do so with nuance– it is not a blunt force tool. Rather, brands should consider which approach to D2C best serves their business need, business model and brand: acquisition/investment; product innovation; and/or participating in D2C channels, as both seller and a matter of influence.

Choose your destination not an approach. Which strategy, if any, is right for a brand needs to consider whether the end goal is to drive distribution, build brand health, mitigate category competition or simply stay relevant amidst rapidly changing consumer preferences and behaviors.

New means = new metrics. While large CPG manufacturers with portfolios may be able to use D2C experimentation as a loss-leader, smaller CPG brands must broach the realities of the channel with eyes-wide-open and a transparent assessment of how they will measure success and what metrics they will need to collect along the way.

Interested in exploring new ways to think about your brand or business? Contact us at engage@weareenvoy.com or follow us on LinkedIn